Benefits of Historic Preservation and Tax Credits

The National Trust for Historic Preservation defines “Historic Preservation” as identifying, protecting, and enhancing buildings, places, and objects of historic and cultural significance. As one of the oldest counties in Maryland and the nation, Anne Arundel County has a rich history that is locally and nationally important. Preserving relics of the diverse archaeological and architectural past reinforces the County’s identity and benefits its communities and residents. Preservation deepens the understanding of physical, cultural, and ecological heritage, drawing people to explore and learn about the past. Rehabilitation of historic structures fosters economic development by creating jobs for local labor and by enhancing the tax base with improved properties. Investing in historic neighborhoods and managing the kind of development that occurs within them reinforces the authentic places that locals and visitors seek, leveraging “sense of place” as an economic asset to promote a high quality of life. Preserving and repurposing old buildings is environmentally sensitive because it reduces demolition waste sent to landfills, maximizes the use of existing infrastructure serving established neighborhoods, and thus conserves undeveloped land. Rehabilitated properties improve property values in the surrounding area and spur other private sector investments. Moreover, historic buildings and objects are tangible resources of our collective heritage that connect us to a specific place in time, persons, or events that can teach us about our history and culture and that as present society we should strive to preserve for future generations.

In order to foster responsible stewardship of historic buildings in Anne Arundel County, the first ever Historic Preservation Tax Credit Program was codified in 2016. Historic preservation tax credits are a proven and effective incentive across the state and the nation in promoting the stewardship and preservation of significant historic resources. Tax credits are an effective tool to encourage private owners to sensitively restore and rehabilitate historically significant buildings. These credits stimulate sustainability and adaptive reuse of existing building stock and can help offset expenses related to rehabilitation on historic landmarks in the county. Through this program, a 25% property tax credit is eligible for both eligible residential and commercial historic properties and 5% for compatible new infill construction within historic districts. Expenditures for certain interior or exterior preservation, restoration and rehabilitation work on landmark properties may qualify for the tax credit, as long as the work meets preservation standards that ensure the historic nature of the property is not compromised.

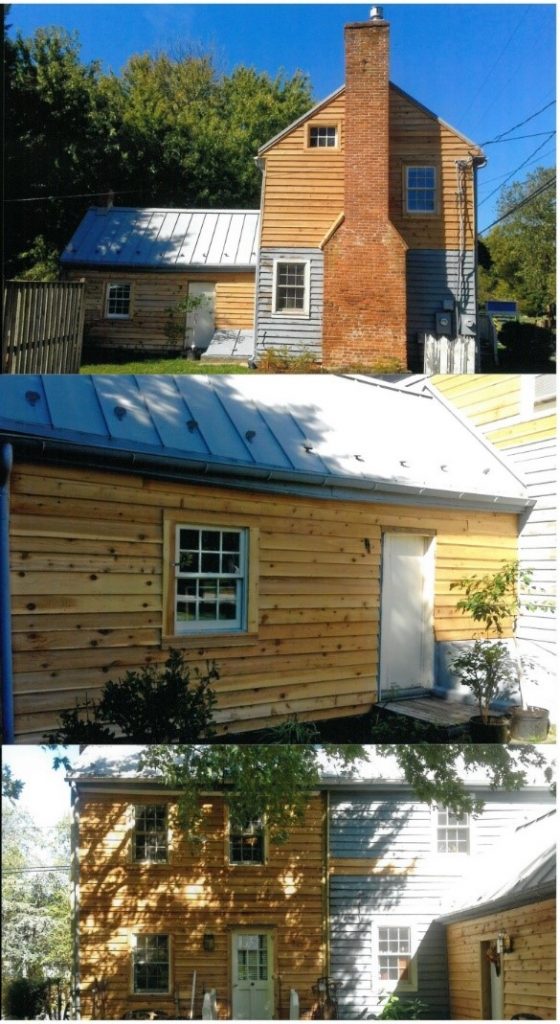

Since 2016, the County has awarded credits for both small- and large-scale projects to commercial rehabilitation projects and residential historic property owners. Some past projects include the re-siding of a historic parsonage building built in 1806, now an antiques store in Friendship; the roof replacement of a late 19th -century contributing historic building within the Davidsonville Historic District (listed in the National Register); and the full rehabilitation of a large Italianate style-farmhouse built c. 1860 in Jessup. The house was rehabilitated into use as a community clubhouse and rental office for the Elms at Shannon’s Glen apartment complex. Rehabilitation work that qualified for the tax credit included foundation repairs, the restoration of original windows, doors, and flooring; in-kind roof replacement, and electrical and plumbing updates to meet current building codes.

For more details on the Historic Preservation Tax Credit, including application forms, qualifying properties, and qualifying types of work, please visit the Office of Planning & Zoning’s, Cultural Resources Section’s website at https://www.aacounty.org/historic-tax-credit.

Contributed by Darian Beverungen, Historic Sites Planner, Anne Arundel County Cultural Resources Section.